Turbotax Advance 2020 Review

Turbotax Advance 2020 Review - Tag: TurboTax refund advance 2020 reviews, TurboTax advance 2020, TurboTax advance 2019, Turbotax refund advance 2020, TurboTax advance loan 2020, TurboTax advance 2020 reviews, TurboTax 2020 review, Turbotax 2020 Free Download, TurboTax 2020 Free Edition, TurboTax USA, TurboTax UK, TurboTax Canada, Turbotax Germany, TurboTax refund advance 2020 reviews, TurboTax advance 2020 review, Turbotax loan 2020 review, USA, UK, Canada, America, Australia, Europe. Turbotax Advance 2020 Review

Intuit TurboTax gives tax refund advances with no hobby and a completely on-line utility method. You’ll receive a part of your tax refund as an enhance whilst you e-report with TurboTax — there’s no separate application. And your credit score received’t is the most effective element that determines your approval selection. The size of your federal refund and your tax information can even play a position.

However with a shorter window to grab an increase and a low maximum refund quantity of $2,000, it could not be the right preference if you received your W-2s late or need a bigger improvement. And you couldn't get your budget without delay deposited into your bank account — you’re stuck getting your whole increase on a prepaid debit card. Turbotax Advance 2020 Review

TurboTax is a tax-instruction software program that lets you file your tax go back online. The business enterprise gives a no-interest refund to strengthen loans at the start of the tax season. Loans variety from $250 to $2,000 and is based on your expected federal tax refund.

To be eligible, you’ll have to use TurboTax to e-file your federal tax go back. In case you’re anticipating a federal refund whilst you file your taxes with TurboTax, you may apply for a refund strengthen. And if you’re approved (after the IRS procedures your refund), your mortgage quantity, minus any relevant expenses, could be deducted automatically and any remainder of your refund may be deposited onto a prepaid Visa card. Here’s what else you need to understand about TurboTax Refund develop loans.

Turbotax Advance 2020 Review

TurboTax will publish your go back once the IRS starts accepting tax returns, which in recent years has been in late January. If accredited, you could install your account to use your rapid Card records to save online anywhere Visa is conventional. But you’ll wait for five to 10 enterprise days for the card to reach within the mail.

Because the common expression states, “coins is king.” when you have a pressing financial want and enough liquidity can solve your problem, you make movements within your monetary toolkit. With tax refunds, after filing your go back and knowing you've got a respectable bite of coins coming your way may be empowering, if most effective it could show up sooner. While you encounter such cash crunches, not needing to borrow on an expensive line of credit (e.G., credit score playing cards, personal loans, or Payday loans) can serve as a precious tool.

Turbotax Advance 2020 Review

Some refund develops loans come freed from fee, costing you nothing and simply act as a product characteristic to attract you to that corporation’s tax training product. In times like those, exploring money back strengthen loan may act on your pleasant interest as it presents the budget you need now at no cost in opposition to money you realize might be yours within the close to destiny.

However, not all merchandise is created identical. Some merchandise, like Jackson Hewitt’s pass big Refund advance loan, costs a 2% rate and interest. In addition, the calculated annual percentage charge, or APR, is 29.2% under the assumption the loan duration lasts 25 days. The powerful APR will range, but, primarily based on the number of days exceptional at the mortgage. Mortgage amounts are to be had between $1,000 – $6, four hundred to qualified debtors beginning on January 2, 2020, through February 2, 2020.

Because of those high charges, make sure to study the high-quality print on whether those merchandise fee you anything as well as the way you acquire the finances. Some creditors require the funds to appear onto branded debit cards, proscribing your liquidity to activities that take delivery of debit playing cards or coins (ATM withdrawal, although withdrawal prices may additionally apply).

Get $250 – $2,000† typically within

1 hour of IRS acceptance

Without Refund Advance it can take up to 21 days to get your refund.

Three easy steps to your advance:

- Right before you file, choose Refund Advance† for your refund option.

- How do I pre-qualify?

- If approved, get your Refund Advance and start spending online typically within 1 hour. Your physical Turbo® Visa® Debit Card will arrive in 5-10 business days.

- Then, once the IRS processes your return, the remainder of your refund will be loaded onto your Turbo Card (usually within 21 days).

Read More:Turbotax Tax Return App for Apple DevicesTurbotax Home & Business DownloadTurbotax Free Online Tax Software | Canadian Free Tax Software

How much can I get?

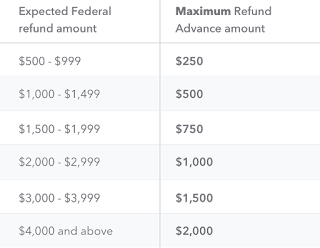

- This amount is based on your federal refund amount, personal info, tax info, and any third-party data we may consider. Refund Advance is available in amounts of $250, $500, $750, $1,000, $1,500 and $2,000.

- This table shows the maximum Refund Advance for each expected refund range. Keep in mind this is only one of the factors that determine your Refund Advance amount.

Offer details and disclosures for Refund Advance Program:

Refund Advance is a loan based upon your anticipated refund and is not the refund itself. To apply for the Refund Advance, you must file your taxes with TurboTax. Availability of the Refund Advance is subject to satisfaction of identity verification, certain security requirements, eligibility criteria, and underwriting standards. Refund Advance is provided by First Century Bank, N.A., Member FDIC, not affiliated with Intuit or Green Dot Bank, Member FDIC.

Separate fees apply if the taxpayer selects a Refund Transfer. A Refund Transfer is not required for the Refund Advance loan.

Not all consumers will qualify for a loan or for the maximum loan amount. If approved, your loan will be for one of six amounts: $250, $500, $750, $1,000, $1,500 or $2,000. Your loan amount will be based on a portion of your anticipated federal refund. You will not receive a final decision of whether you are approved for the loan until after you file your taxes. Loan repayment is deducted from your federal tax refund and reduces the subsequent refund amount paid directly to you.

Fees may apply for other products and services.

Your loan proceeds will be available on a Turbo® Visa® Debit Card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. You may access your loan proceeds by multiple methods without paying additional fees. Find fee-free ATMs to withdraw cash by logging into your account at TurboDebitCard.com. Additional card fees may apply.

You will not be eligible for the offer if: (1) your physical address is located outside of the United States, a US territory, a PO box or a prison address, (2) your physical address or the tax returns you are filing are in one of the following states: IL, NC, RI, VT, (3) you are less than 18 years old, (4) the tax return filed is on behalf of a deceased person, (5) you are filing certain IRS Forms, (6) your expected refund amount is less than $500, or (7) you are using any of our tax products where a professional is completing your taxes. You also must be approved by Green Dot Bank, Member FDIC to receive a Turbo® Visa®Debit Card.

If you are approved for a loan, your tax refund after deducting the amount of your loan and minus any agreed-upon fees will be placed on a Turbo® Visa® Debit Card. If you apply for a loan and are not approved your tax refund will be placed on a Turbo® Visa® Debit Card minus any agreed-upon fees. Approved pending confirmation of loan tier amounts in the contract and state licenses approved.

TurboTax tax refund advance requirements:

To qualify for a tax refund advance from Intuit TurboTax, you need to meet the following criteria:

- Federal refund is at least $500

- E-filing your federal tax return through TurboTax

- At least 18 years old

- Not filing an Illinois, North Carolina, Rhode Island or Vermont state tax return

- Not filing a 1310, 1040SS, 1040PR, 1040X, 8888 or 8862 form

TurboTax offers its refund advances through Green Dot Bank, which might have additional eligibility requirements not listed. Get free for Turbotax Refund Advance: Start For Free

0 Response to "Turbotax Advance 2020 Review"

Post a Comment